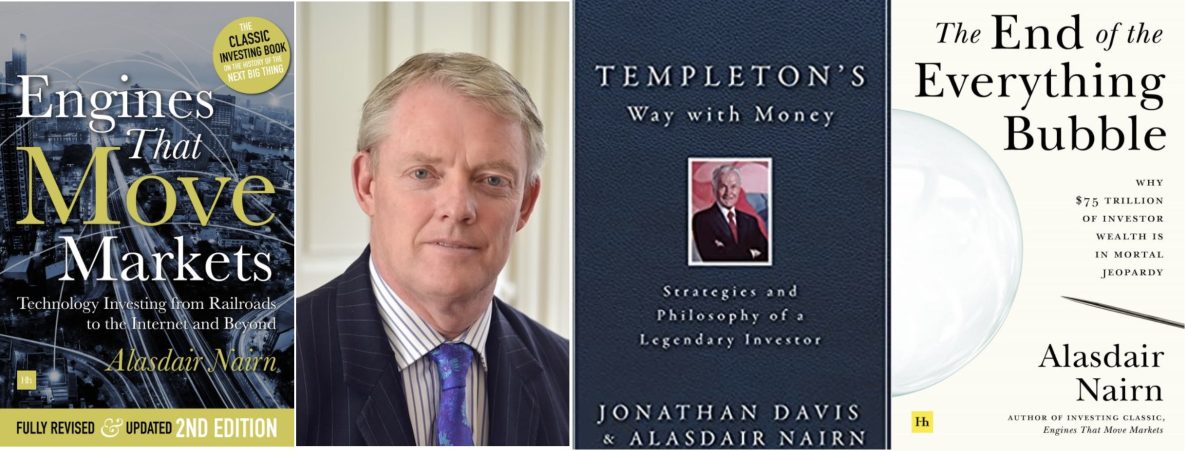

A warm welcome to everyone who is interested in reading or learning more about my books on investing, together with my latest thoughts. My next title, to be published in 2026, is a study of Artificial Intelligence – what it is, why everyone is talking about it and what it all means for investors. The book draws on my earlier research into technology and market cycles. You can sign up here to receive exclusive pre-publication extracts before the book is published. Simply put your email address into the box to the right of this page.

My new book: Digging into AI

Artificial intelligence is the latest technological advance to send the stock market into a frenzy, but how significant is it? And how will it all play out for investors? These are the questions which my new book, due out in 2026, sets to answer. Building on the analysis that underpinned my earlier book, Engines That Move Markets, and based on two years of intensive research and discussion with AI pioneers, the book puts the current excitement into context and maps out how AI will change the world of work and who the likely winners and losers will be.

I shall be releasing segments of the ten chapter book in advance of final publication, covering everything from the history of AI, the reasons it is taking off now, what it can do and who will win the race to dominate this brave new world. While there are already many books about AI out there, this is the first to be researched and written by a full time professional investor who has studied the market impact of all the biggest technological changes of the last two hundred years, from the canals and railways onwards.

Understanding the meaning of AI and its potential impact is the most important issue facing any investor today, as we all try to navigate our way through this transformative moment for society. This is my take on how it will all play out. Simply put your email address into the subscribe box on this page and you will automatically receive extracts as they are released.

January 6th 2026

Understanding AI: a first take

Artificial Intelligence has been dominating the media and investment landscape for months as tools such as ChatGPT introduce AI’s capabilities to the general public. The press coverage ranges from the apocalyptic (“end of the world”) to the messianic (a coming productivity and innovation miracle which will save the world). Capital has certainly been flowing to AI, with private investment estimated at approximately $120bn last year, with the US accounting for about two thirds of the total, while Nvidia and other listed companies have dominated the performance of leading public market indices.

However, when one meets with corporates or reads most of the press, what is striking is the lack of precision in the discussion. AI is commonly referred to in generic terms, despite it being both multi-faceted and at various stages of development, depending upon which facet one is referring to. This is normal for an emergent technology but to understand the potential ramifications much more granularity is required.

As a starting point, it is helpful to spend some time with people who are at the leading edge of recent developments and try to explore some of the obvious questions with them. In 2022 a team from Glasgow University won the prestigious Amazon Alexa Prize Taskbot Challenge and have since recently launched Malted AI, a new company that aims to develop AI for the corporate sector, in which I have invested. Follow this link to read my Q and A with them about the potential and challenges of this exciting but not clearly understood technology.

November 15th 2024

UK election special podcast

The UK heads to the polls in a general election on July 4th 2024, with the opposition Labour Party widely expected to win a large majority and move into government for the first time since 2010. What are the challenges and opportunities that will face this new administration – and how constrained will they be in practice by fiscal constraints after several years of crisis and rising debt levels.

These are the important issues that I discussed with an expert independent panel on the latest edition of the popular Money Makers podcast hosted by Jonathan Davis. Joining me for this high level 40 minute conversation are Nick Macpherson, former permanent secretary at the Treasury from 2005 to 2016, and now a cross-bench peer in the House of Lords, and Ed Balls, journalist, broadcaster and former MP and Cabinet minister.

Trouble ahead? A second opinion

My recent paper Recession or No Recession? laid out the case that a recession is much more likely than financial markets are currently assuming. For an independent second opinion I turned again to Lord Macpherson, former Permanent Secretary at the Treasury, now a visiting professor at King’s College, London and a cross-bench peer in the House of Lords. Nick Macpherson has both a deep knowledge of economics and many years of experience in practical policymaking, having been the head of the Treasury before, through and after the global financial crisis. Here is a link to the article.

October 15th 2023

Analysis: Recession or not?

Market participants remain divided whether the US and global economies can avoid a recession. In this latest analysis piece, I examine the evidence on both sides of the argument and conclude that, despite welcome resilience to date, there is little realistic chance that a recession can be avoided, with inevitable further consequences for asset prices. The complacent assumption that, if economic conditions deteriorate, there will still be a return to free money remains prevalent in many quarters. The return of inflation and rising interest rates, in other words, have not so far punctured “the everything bubble” completely. Here is a link to the article. http://www.globalopportunitiestrust.com/recession-no-recession/

July 31st 2023

Analysis: An opera of canaries

Although they have been treated by many market participants as isolated and unrelated shocks, three recent episodes – the collapse of the cryptocurrency exchange FTX, the failure of Silicon Valley Bank and the UK pension fund crisis in autumn 2022 – should more realistically be seen as accidents waiting to happen and harbingers of more market disruption to come – what I call “canaries in the mine”. In this latest article I explain what binds these three episodes together and why they won’t be the last such disruptive events investors will face before the “Everything Bubble” finally deflates. The collective noun for canaries is an opera, hence the title. This is the link to the article.

April 7th 2023

Analysis: Are we there yet?

My view is that the bear market in equities is through the first phase of its decline but the most recent rally is not sustainable and there will be at least two more phases before it is over. Persistently poorer economic news is likely to emerge in the second half of this year, leading to a marked deterioration in investor sentiment. The emergence of this kind of gloomy sentiment and commentary will be a classic signal that the trough of the bear market may finally be imminent. As we work our way through what will be a difficult market environment, policy will in due course be loosened, but a time lag will again come into play. Here is the link to the article.

March 31st 2023

Q and A: Crunch time for policymakers

Sandy Nairn discusses the fallout from the global financial crisis and how governments have responded with one of Britain’s most distinguished civil servants, Lord Macpherson, the former Permanent Secretary at the Treasury (2005-2016) and as such a a key player in guiding policy through the global financial crisis (GFC) and helping to ensure that the crisis did not spiral downwards to precipitate a rerun of the depression of the 1930s. But has the initial success of the policy response to the crisis been undermined by the reluctance of policymakers subsequently to end the exceptional easy money/fiscal stimulus that followed? This Q and A (link here) explores the issues and the mis-steps that have led to today’s siding financial markets.

October 15th 2022

A and A: Cybersecurity – risks and threats

In this extended interview with Sir David Omand, a former Permanent Secretary of the Home Office and Director of the Government Communications Headquarters (GCHQ), I discuss the threats companies face from cyber-attacks. I found it reassuring and disturbing in equal measure. The reassuring elements included examples of just how much the security services do to protect the public both individually and collectively in the form of public services and corporates. The disturbing elements included the sheer scale, geographic dispersion and state support for the range of nefarious activities that threaten companies and individuals. Understanding cybersecurity is a must subject for any investor. This is the link to the article.

Q and A: Is the Covid pandemic over?

In late December 2019, the World Health Organization (WHO) was notified of a cluster of pneumonia cases in Wuhan City, China. Although it took some months for the significance to be recognized, this proved to the emergence of Covid 19, the virus which triggered a global pandemic and forced entire economies into lock-down, unemployment to soar and GDP to slump. In this updated Q and A (link here) Sandy Nairn discusses what we now know (and also what we still don’t know) about Covid 19 – its causes and effects – with Professor Gerry Graham, an expert advisor in the area of biological sciences.

September 15th 2022