How is the stock market on-off love affair with artificial intelligence going to play out? Will there be a market bloodbath? My colleague Alan Bartlett and I gave our thoughts in a recent event at a big fund management event in Germany. You can read the transcript by following this link. Here are a couple of short extracts, detailing the arms race between OpenAI and Anthropic:

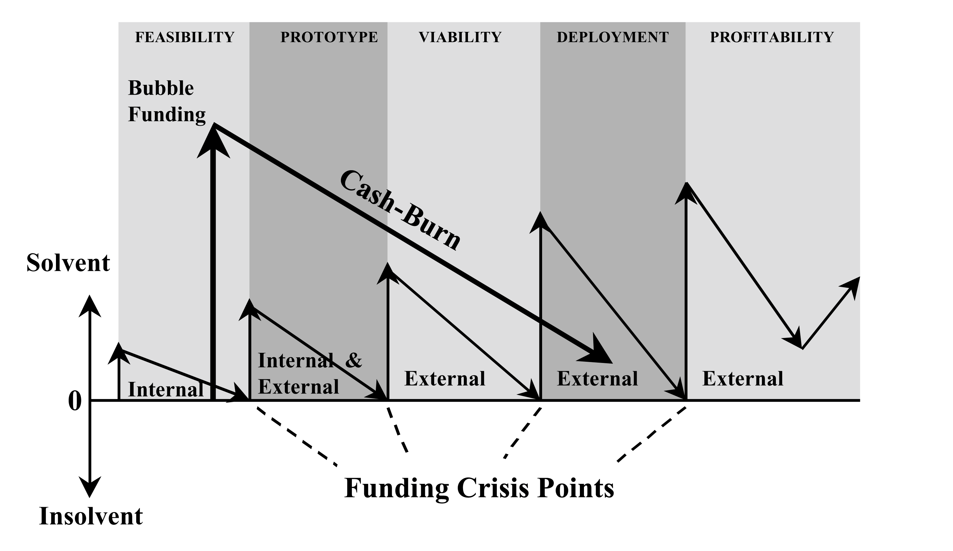

Q: You have developed a five-phase model for investment booms. Are we already through the prototype phase?

I think we are way past the prototype. We are already in the deployment phase. And the most pressing issue for financial markets is that companies like OpenAI or Anthropic really do not have much by way of revenues. Their revenues are in the billions, but their costs are in the tens of billions in terms of compute power. So they need to either raise capital to pay for all these data centers, or they are in trouble.

Five Phases of a Boom: The Dynamics of Technology

What will cause the financing crisis for AI companies that you expect?

Sales will not increase fast enough. Only 5% of OpenAI users pay subscription fees. That’s why Anthropic and OpenAI are always raising new capital and are preparing IPOs……The question is where OpenAI and Anthropic can generate sufficient revenue. From my point of view, only advertising can generate sufficient revenues to cover their costs. But this is more difficult than it was for the internet companies.

Q. Why is that?

Because the internet companies did not have competition online. Google basically got 90% of search online advertising revenues, and achieved profitability after three years. But if OpenAI wants to get online advertising revenues, it has to take them from Google. That’s a very different battle. OpenAI and Anthropic have to get into competition for advertising revenues. That is going to be a bloody battle, because Google is at the forefront of all of these technologies and it cannot afford to lose. I don’t know how long this battle will last.

Other topics covered include:

Long term winners and losers from AI;

AI’s impact on the professions;

Small language models; and

Overvaluation of the US stock market.